ev charger tax credit extension

After expiring at the end of 2021 the Internal Revenue Code Section 30C tax credit for electric vehicle charging stations is back. What does this mean for you.

Federal Tax Credit For Ev Chargers Renewed

Learn more on our blog.

. The EV Charger Tax Credit Gets A 10-Year ExtensionAnd A Few Upgrades. A recently expired tax break for electric vehicle EV chargers got new life under the recently passed Inflation. The tax credit works by offering a tax credit of 30 of all costs you have incurred by purchasing and installing EV chargers up to 1000 total credit.

Electric Vehicle EV and Fuel Cell Electric Vehicle FCEV Tax Credit. Since the beginning of the year it has been unclear whether Congress would renew this credit for projects completed in 2022. With the passage of the IRA the federal tax credit.

Before the Inflation Reduction Act the limit on the amount of the EV charger tax credit for businesses was 30000 which still applies to projects completed before the end of. The tax credit for residential and commercial EV charger installations was recently extended. EV Charging Station Tax Credits are Back.

Notably the extension of the Section 30C credit has the potential to make tax equity investment in EV charging infrastructure available more broadly. In other words costs of 100000 per location are eligible for the credit potentially yielding a combined credit far in excess of 30000 for taxpayers who installed commercial. Email the Technical Response Service or call 800-254-6735.

Inflation Reduction Act Extension of the Section 30C Tax Credit Thursday August 25 2022 After having expired at the end of 2021 the. View source Send. EV Tax Credit Expansion First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10.

The Federal Tax Credit for Electric Vehicle Charging Equipment EVSE has been extended through 12312032. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial. This is a one-time nonrefundable.

This tax credit covers 30 up to 1000 per unit of the cost for. Taxpayers are eligible for a credit of 30 of the hardware and installation costs for EV chargers installed in your home after December 31 2021. The tax credit for a.

Technically referred to as the Alternative Fuel.

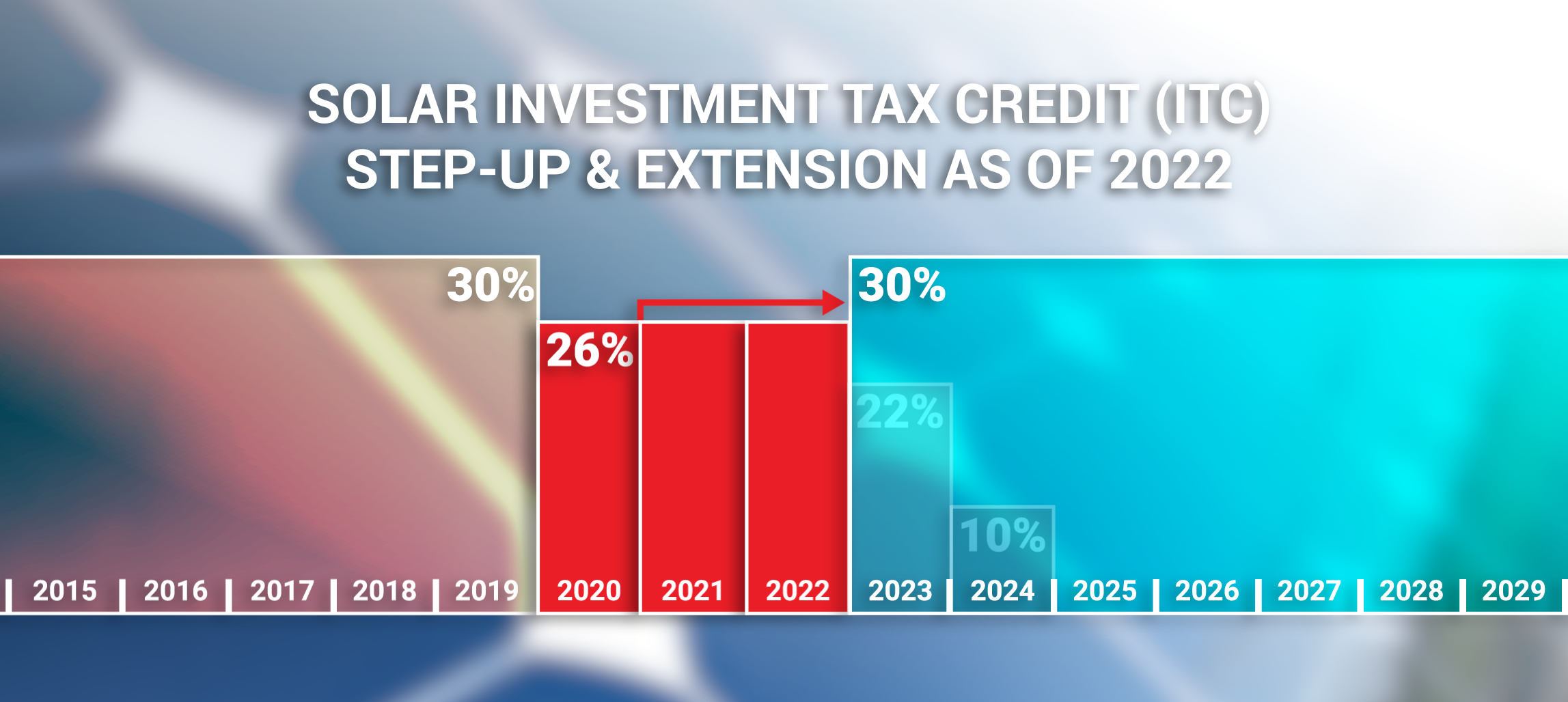

2022 Solar Investment Tax Credit Itc Increased Extended

Solar Itc Extension Becomes Law Zenernet

Amazon Com Hikity Nema 5 15 Level 2 Portable Ev Charger 220v 16 Amp With 5m Extension Cord Electric Vehicle Ev Charging Station Compatible With J1772 Evs Automotive

Beyond Bid Getting Ev Charging Plugged Into Reconciliation Third Way

U S Democrats Propose Dramatic Expansion Of Ev Tax Credits That Favors Big Three

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Ev Charging Tax Credit Integrated Building Systems

No Free Parking Philly Electric Vehicle Owners Face Challenges Of Charging

Ford F Gm Toyota Lobby To Fix Electric Car Tax Credit In Senate Deal Bloomberg

Amazon Com Couplago 40 Ft Long 40amp Rated 220v 240v Ev Charging Extension Cable For Electric Vehicle Charging Stations Compatible With All J1772 Plug Automotive

Maximize 2021 Electric Vehicle Charging Station Tax Credits Wipfli

Every Electric Vehicle Tax Credit Rebate Available By State

Electrification Coalition Inflation Reduction Act Impacts On Electric Vehicles

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

Usa Ev Charger Installation Federal Tax Credit Extended R Electricvehicles

Federal Tax Credit For Ev Chargers Renewed

What Does The Inflation Reduction Act Ira Mean For Ev Charging Tritium Tritium

Biden S 500 000 Ev Charging Stations Get A 5 Billion Start Salon Com